WHAT DO WE DO?

Ambessa Capital injects more than money into your business

Ambessa Capital is a Private Equity firm that invests in African companies along the value chain of food and beverage (except alcohol) sectors. Our major focus is on import substitution and export oriented companies. Our impact target is to create quality jobs and contribute to regional development.

Owners of middle market companies partner with Ambessa Capital when they need EUR 0,5 million to EUR 5 million in capital from a financial partner with deep operating experience to achieve their growth strategies or to convert from importer to producer.

We provide business owners and entrepreneurs the required capital, technical assistance as well as our network to strengthen the company´s market position and grow its value.

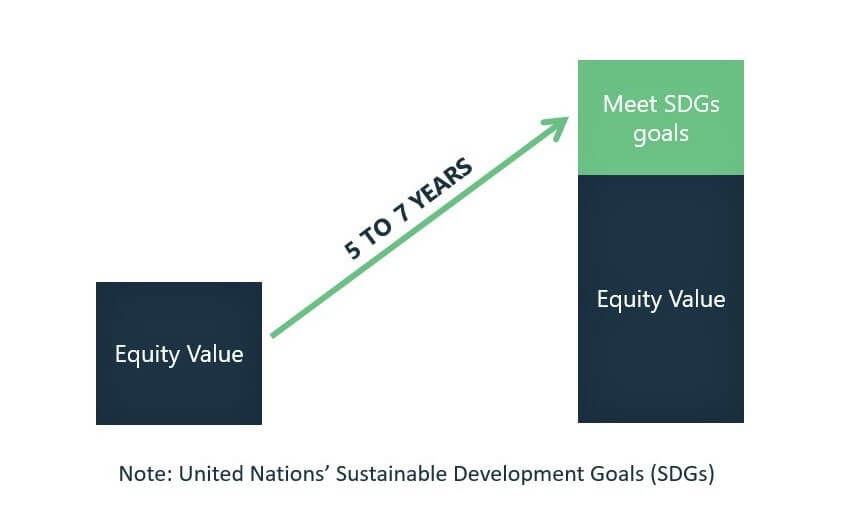

Value is created over 5 to 7 years by combining your business and industry knowledge with our expertise in creating equity value.

Increase Equity Value contributes to income generation, quality jobs and economic growth of the country.

OUR APPROACH

Investment Process

Ambessa Capital´s philosophy is based on partnership. Our aim is to build strong relationships with business owners in order to transform middle companies into market leaders as a manufacturer.

We believe that our collaborative relationship with management as their financial sponsor leads to well-defined, sustainable strategies that drive value creation.

Our Impact Investing due diligence program requires an assessment of quality job and local value creation areas which may impact the current or future performance of a company.

Firm Value

Partnership

Combining your business and Sector knowledge with our expertise and experience.

Integrity

We seek for a healthy relationships based on trust and respect. This allow us to leverage our partner’s strengths and complement their weakness to create value.

Accessibility

Our flat organizational structure gives business owners, management team and Sponsors direct access to decision makers.

Respect

We respect the legacies business owners have built and want to continue to built on those success path.

Example Roadmap to close a deal

| Activity | Week1 | Week2 | Week3 | Week4 | Week5 | Week6 | Week7 | Week8 | Week9 | Week10 | Week11 | Week12 |

| Sign Letter of Intent & NDA | ||||||||||||

| Financial Statement & Business model analysis | ||||||||||||

| Financing Activities | ||||||||||||

| Contact potential Investors and obtain financing proposal | ||||||||||||

| Drafting Loan document | ||||||||||||

| Loan documents finalized | ||||||||||||

| Due Diligence Activities | ||||||||||||

| Ambessa Capital visits and spends several days with Management, CFO and Accountant | ||||||||||||

| External Accounting Firm delivers Final Due Diligence Report | ||||||||||||

| Ambessa Capital Performs Background check on Management | ||||||||||||

| Ambessa Capital & Management speaks with Top 5 Customers | ||||||||||||

| Ambessa Capital & Management speaks with Top 5 Suppliers | ||||||||||||

| External Attorney perform Legal Due Diligence | ||||||||||||

| Impact Team visits and Examines the Company | ||||||||||||

| Transaction Documentation Activities | ||||||||||||

| First Draft of Transaction Documents and Agreements Delivered | ||||||||||||

| Revision and Finalizing Draft of Transaction Documents and Agreements |

IMPACT INVESTING

Reforms and infrastructure investments led to long-term transformation and structural growth in Africa. However, natural resources and commodities are still the backbone of many African economies. Furthermore, most African countries import more than they export. Given the growing population in Africa this economic structure will intensify the unemployment and foreign currency situation in those countries.

The drivers of economic growth and long-term sustainability for African markets lie in the potential and effective development of the small and medium enterprise (SME) sector. Currently, SMEs are growing below their potential. The reason for that is lack of capital, technology and know-how.

Technical Assistance plays a crucial role in Ambessa capital strategy. We provide capacity building support to improve Investees performance as well as strengthening our portfolio by reducing risk. Ambessa Capital uses its regional and technical expertise to create quality jobs and sustainable enterprise strategy to improve livelihoods across the region thereby promote economic development.

INVESTMENT CRITERIA

We Focus Exclusively On The Middle

Market Of African Companies

We strive to create maximum value in our portfolio companies by combining

business owners strategic and investors impact investing goals.

Investment Size

EUR 0,5 million to

EUR 5 million

Revenue

Above EUR 0,4 million

Geographic focus

Africa

Uses of Funds

Organic growth/Expansion

Converting importer to manufacturer

Target Industries

Along the value chain of food and beverage (except alcohol) sectors

EBITDA

> EUR 0 (or clear path to positive EBITDA)

Impact Target

Quality jobs creation and local value adding.

Company

Characteristics

|

CLEAR SUSTAINABLE

|

|

ATTRACTIVE

|

|

STRONG GROWTH

|

|

EXPERIENCED

|

PORTFOLIO

Investment Pipeline - List of investable companies

TEAM COMPOSITION AND EXPERIENCE

TADIOS TEWOLDE

TADIOS TEWOLDE is the Fund Initiator. As a CEO of Moringreen Trade and Consulting he supported African Entrepreneurs in the area increasing productivity and obtaining financing. Prior to this he worked as an Economist for the European Central Bank and Deutsche Bundesbank. He holds a Degree in Master of Science in Quantitative Economics as well as a Degree in International Business Administration and Foreign Trade.

Dr. RUDOLF MÜLLER

Dr. RUDOLF MÜLLER was the managing partner of a family-owned industrial company with today 400 employees, with a worldwide distribution and subsidiaries abroad. After completing his doctorate in business administration, he completed a master’s degree in business psychology.

Contact Form

![]()

Ambessa Capital (i.G.)

c/o Moringreen Trade and Consulting GmbH

Walther von Cronberg Platz 9

60594 Frankfurt

![]()

africa@ambessa.capital

© 2019 All Rights Reserved. Ambessa Capital.